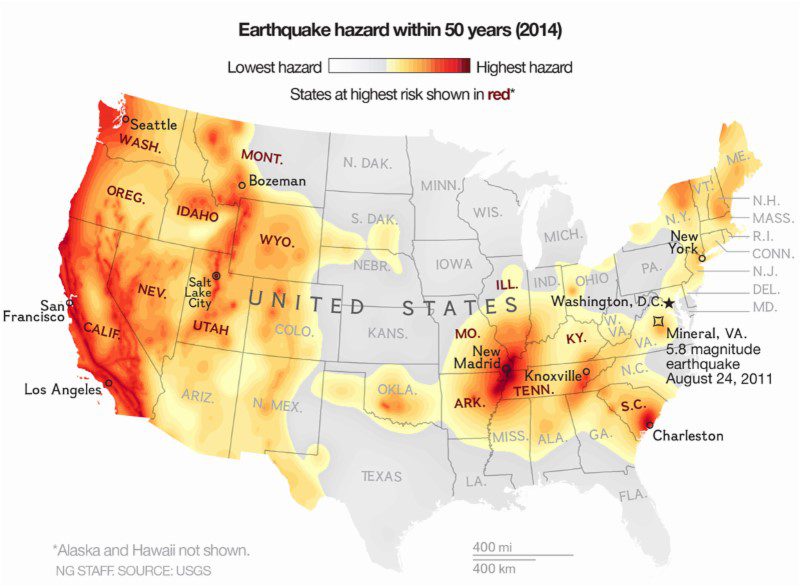

Earthquake Risk is Real

September 26, 2017

Why I Should Buy Homeowners Insurance . . .

October 17, 2017Ten Ways to Lower Your Homeowners Insurance Premium

Homeowners Insurance prices may vary greatly depending on many factors. The following items are worth contemplating before buying your home insurance.

-

Get Quotes

This step shouldn’t take long but may save you some money. It is best to ask your family and neighbors which company they are insured with; it is likely that they may have already done the homework you are about to begin. The National Association of Insurance Commissioners (www.naic.org) has information to help you choose an insurer in your state, including listing consumer complaints. It is important not to consider price alone; after all, insurance is meant to properly indemnify you at the time of need. The insurance company should offer a competitive price and the level of service you would expect should you file a claim. Check the financial stability of the companies you are considering with rating companies such as A.M. Best (www.ambest.com) and Standard & Poor’s (www.standardandpoors.com/ratings). It is always a good idea to get 3 comparable insurance quotes from your most desired 3 insurance carriers.

-

Deductible Options

The Deductible is the amount of money the insurance company deducts from the payout of a loss. The higher the deductible, the lower your insurance premium. These days, most clients elect to take the highest deductible which they know they can handle in the event of a claim. Homeowners may file a claim once every 10 – 15 years; thus, it may be prudent to multiply the annual premium by at least 10 when comparing the difference in premium outlay. In most cases, you’ll find that the customer ends up paying the deductible, the insurance company seldom loses – thus, the higher deductible is always the long term best option. Homes located in high wind, tornado or hail stricken areas, it is most common for the policy to have a separate ‘Wind & Hail’ deductible separate from the policy deductible labeled ‘All Other Perils Deductible’. In some areas, earthquake insurance is available on the same policy as an endorsement; in this case, the deductible would also be listed separately for that peril.

-

Dwelling coverage and property market value are not the same value

Insurance companies do not offer coverage for the land; fire, hail, wind or theft will never cause harm to the land. Homes are insured for their reconstruction cost; this value is listed as ‘Dwelling’ on the homeowners or landlords policy. Depending on the market value in the specific area, the reconstruction cost may be lower or higher than the dwelling reconstruction value. You must note that the reconstruction of a home may by an individual contractor will most likely be much higher than the cost to the original developer for the area. Insurance companies use a common construction industry guide software to calculate the coverage amount to reconstruct a home.

-

Update home to reduce disaster risk

Each insurance company may have available discounts for homes which have taken steps to become more weather resistant. For example, you may be able to save on your premium by adding storm shutters, reinforced roofing or buying stronger roofing materials. Older homes can be retrofitted to make them better able to withstand earthquakes. Discounts may also be available for modernized heating systems, plumbing and electrical systems to reduce the risk of fire and water damage.

-

Upgrade home security

Most insurance companies offer a small discount of 2 – 5% for having deadbolt locks, smoke detectors and a Fire Extinguisher; interestingly enough, you’ll find that all homes get this discount because the same insurance companies require the home to have all 3 items in order to insure the home. Carriers offer as much as 15 to 20 percent discount if the home has an interior fire sprinkler system and a centrally monitored fire and burglar alarm system. As of late, many customers opt to install do-it-yourself type alarm systems and security cameras; insurance carriers offer only a professional monitoring discount by a licensed alarm company, thus discounts for self-monitored systems are not commonplace.

-

Seek other discounts

Some carriers have different discounts which vary from state to state. Typically, the insurance companies with the higher rates have more discount options such as: Retired Discount, Non-Smoker’s Discount, Professional Discounts or University Education Discounts. No matter which carrier you choose to insure your home with, it would be beneficial to ask about all the available discounts.

-

Maintain good credit

There are only 4 states in the Union which don’t allow credit scoring for insurance premium rating purposes. The majority of the nation understands that homeowners with good credit scores may be less likely to embellish an insurance claim for the purpose of profit. If you live in a state which allows credit scoring, a solid credit history can cut your premium. Insurers are increasingly using credit information to price homeowners insurance policies. In most states, the insurance company is required to advise you of any adverse action. In order to protect your credit score, pay your bills on time, don’t unnecessarily apply for more credit than you need and keep your credit balances low.

-

Remain loyal to same insurer

Loyalty discounts do exist but are not legal in every state. Some companies offer a loyalty credit on an increasing scale depending on the length of time you’ve kept your policy. While it is important to earn the discount, it is equally important to compare the premium of other carriers every few years.

-

Review your policy thoroughly every 3 years

The purpose of insurance is to protect your belongings and liability exposure. Every few years, it is important to review your coverage and make sure that your policy is still sufficient to protect your assets from the risks you are insuring against. At the time of review, you may reduce or increase coverage based on your needs at the present time.

-

When buying a home, consider the cost of homeowners insurance

It is certainly true that newer homes in suburban communities away from hazards will generate the lowest insurance premium; however, there are many other factors. Homes closer to a fire hydrant, closer to a fire station, in a gated community, homes with updated electrical, heating and plumbing systems and homes with tile roofs will be helpful in obtaining a lower premium.

In many states, the Department of Real Estate requires Real Estate Agents to provide the CLUE (Comprehensive Loss Underwriting Exchange) report of the home you are thinking of buying. These reports contain the insurance claim history of the property and can help you judge some of the problems the house may have.

Flood insurance and Earthquake damage are not covered by a standard homeowners policy. If you buy a house in a flood-prone area, you’ll have to pay for a flood insurance policy which is underwritten by NFIP (division of FEMA). The Federal Emergency Management Agency provides useful information on flood insurance at www.fema.gov/nfip/. A separate earthquake insurance policy will be needed if you wish to be covered against the peril of earthquake or earth movement.