Personal Umbrella Policy – PUP

September 4, 2019

Landlord Protection for Rental Homes

September 10, 2019Why on earth would a homeowner want to buy 2 insurance policies instead of a Homeowners Insurance Policy?

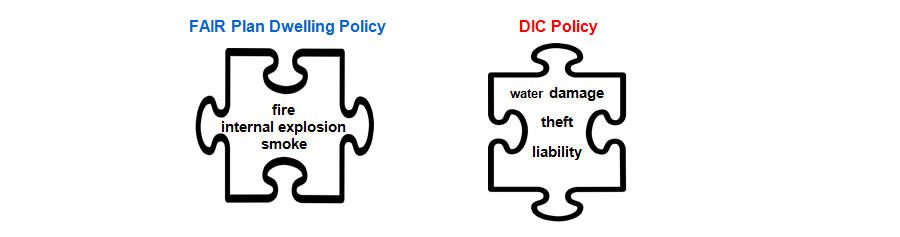

In areas where there is a high risk of brush fires, preferred insurance companies will not accept the issuance of home insurance policies. Since fire and smoke are generally the great concern in such areas, the homeowner would need to purchase a Fair Plan Policy to provide the basic Fire & Lightning coverage. Fair Plan policies are clearly not a replacement for homeowners insurance policies; however, they are the necessary basic from where to purchase an additional Difference in Conditions Policy to hopefully fill the gaps where the Fair Plan doesn’t offer coverage.

The most common items which are not covered by the Fair Plans are: Water Damage, Theft & Personal Liability. The aforementioned items are included in Homeowners Insurance Package Policies. For those homeowners who are very coverage conscious and wish to have comprehensive coverage, the Fair Plan and DIC Policy may well be the only option. At the present time, there is a coverage crisis in California; carriers have decided to leave the state due to increasing loss ratios in the preceding years, for the same reason, all remaining carriers are increasing premium to maintain their financial stability in the market.

Homeowners living outside urban areas are finding themselves faced with non-renewal notices, searching for a new home insurance company but many times, to no avail.

Two Separate Policies to mimic Homeowners Insurance …

With both the Fair Plan and the DIC Policy, a homeowner will be able to purchase both the underlying and very necessary fire insurance on the property as well as use the DIC policy as a wrap around to complete the circle of necessary coverage that any homeowner would wish to have. We couldn’t imagine having a homeowners policy without water damage coverage, theft or liability.

Brush Hazard Insurance – on the cheap …

For those property owners who are only interested in basic fire insurance, they may purchase the Fair Plan policy; there are deductible options which would further allow the consumer to reduce the premium outlay. Clients must bare in mind that a Fair Plan Policy comes without many necessary coverage items which traditional policies offer; for this reason, Fair Plan quotes are always accompanied by a flier which actually shows the deficiencies of purchasing the Fair Plan policy alone!

Assistance for Fire Hazard Areas …

Homes located in high risk fire areas come with many challenges; it is essential to speak to a licensed representative to get all questions answered and be assured that there is a transparent understanding of all options before proceeding.