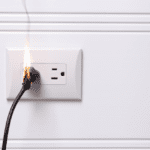

Electrical Safety in the Home

October 6, 2023

Preventing Water Damage to your Home

October 17, 2023Your home is most likely your largest investment; homeowners insurance gives you the protection you need and deserve against Fire, Lightning, and other covered perils. Shopping for Homeowners Insurance has become complicated and involves many different factors in order to obtain coverage. With the increase of frequency of catastrophic events, insurance companies have had to change their rules and increase premium in order to stay viable in the market.

In an attempt to make the process simple, the following may help:

- What is Homeowners Insurance

- Why do Mortgage Companies require Homeowners Insurance

- What are the most common policies, the HO-3, HO-6, and DP-3

- How to get help finding the right policy for your home

Homeowners Insurance:

Homeowners insurance is a type of hazard insurance that provides coverage for losses and damage that occur to or on your property. Your home insurance policy can provide the means to repair or replace damaged property and protect you from liability losses due to negligence. Whether you have a mortgage or have paid in full for your home, it would be inconceivable to leave your investment uninsured.

Why do Mortgage Companies require Homeowners Insurance?

When you apply for a mortgage, the lender puts a major financial investment into your home by providing funds for the purchase or refinance of the property, this interest is the reason for their requirement of hazard insurance naming the Mortgage Company as Mortgagee. In the event of a covered loss that destroys the home, the mortgage company is assured that their interest is insured.

Common Policies: HO-3, HO-6, and DP-3

The most common homeowners insurance policy is the Basic Homeowners Insurance Policy, formally known as Homeowners Policy Special Form 3 – but you’ll know it as HO-3 for short. Second to HO-3 is HO-6. HO-6 is a “walls in” only policy that is structured similarly to HO-3, but covers condominiums and co-ops. The third most common policy is the Dwelling Fire Special Form 3, known as the DP-3 or Landlords Policy. It’s important to understand what these policies both cover and don’t cover.

All policies are comprised of six distinct coverages that offer protection in case of damage to your property, personal belongings, or exposure to personal liability:

- Coverage A: Dwelling coverage – protects your home, including the structure and any permanent fixtures like plumbing and cabinetry – all items that are a physically attached to the house

- Coverage B: Other Structures coverage – applies to structures on the insured property, but not attached to the dwelling itself (i.e. a detached garage, gazebo or a shed)

- Coverage C: Personal Property coverage – covers your personal property. There are many sub-limits and restrictions for Personal Property, most policies allow for 10% of your personal property limit away from home. Some of the sub-limits include Jewelry, Furs, Silverware, Firearms, etc…

- Coverage D: Loss of Use coverage – provides coverage for additional living expenses as well as fair rental value for rental homes. This coverage kicks in when the insured dwelling suffers a covered loss and becomes inhabitable whether short term or long term.

- Coverage E: Personal Liability coverage – covers costs (up to the policy limit) for damage in which you are considered negligent and typically provides legal defense.

- Coverage F: Medical Payments to Others coverage – Often called “Good Neighbor” coverage, this pays for the medical bills of third parties injured on your property, regardless of fault.

When obtaining your free home insurance quote, you must review the coverage, limits and policy deductible. Each of the line items will have a coverage limit – the maximum the insurance company will pay for a covered loss – and it is important to understand and adjust these limits as needed.

It is best to speak to a certified representative to get all your questions answered regarding covered perils and a complete general understanding of how the coverage applies in the event of a covered loss. Perils are events or incidents that cause damage or loss to your property.

In the event of a claim, your insurance company will pay to either repair or replace your damaged property as long as it is the result of a listed “named peril” and not an occurrence excluded by the policy.

How to fulfill Homeowners Insurance requirements for your mortgage

HDA Insurance helps you find your homeowners insurance policy online.

HDA Insurance can assist further in helping you find insurance even when there are complications due to geographic location, prior claims history or credit rating concerns. Homeowners Insurance would be recommended for owner-occupied homes, Landlord Insurance would be recommended for tenant-occupied homes, Condos or Townhomes would need a Unit Owners Policy, and in some areas of concern, separate policies may be required for Fire, Flood, Earthquake, and perhaps a Difference in Conditions Policy.

If your risk doesn’t fit into a simple cookie cutter scenario, we have many years of expertise helping match you with the right carrier.

Whether you’re looking to buy, sell or refinance your home, HDA Insurance Brokerage is available to insure your new property; whether an owner-occupied home or a tenant-occupied rental unit. You may obtain a FREE Home Insurance Quote Online when you’re ready.