Happy Holidays | Merry Christmas

December 20, 2019

What Is An Impound Escrow Account?

January 8, 2020The primary goal of homeowners insurance is providing the full reconstruction value of your home in the event of a covered total loss; the dwelling coverage limit is a major factor which contributes to the insurance premium rate. Although many homeowners feel that property insurance may simply be a waste of money and it is unlikely that they will incur a loss, we know this isn’t true in any part of the country.

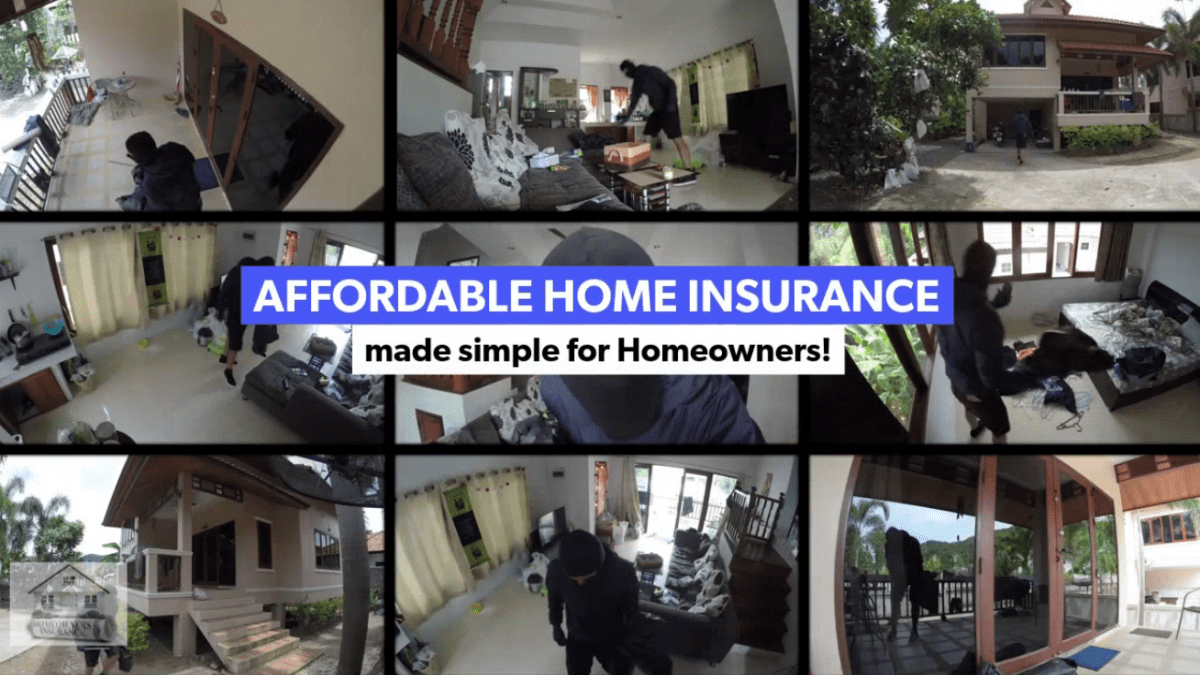

Electrical Fires, Kitchen Fires, Burst Pipes, Burglaries, Vandalism, Wind Damage, Hail Damage, Lawsuits for Negligence, Medical Payment claims by guests etc… The list is endless, homes do have RISK!

What will impact my Home Insurance rate?

- Year Built / Type of Construction – Newer homes come with greater discounts as they have newer systems and utility service connections presenting less risk. Insurance companies use reconstruction cost estimators to calculate the price of reconstruction of the home in the event of a total loss; this value is used as the ‘Dwelling Coverage’.

- Remodeling / Renovations – It is important to mention any upgrades which may have been made to the home since it was built. For instance, an upgraded Electrical Panel, a new Heating Furnace, new Windows, or perhaps a new Hail Resistant Roof. Not only will these items need to be replaced in the event of a loss but the updates may also provide a discount.

- Security Systems – Most insurance carriers do provide a Monitored Alarm System credit, this would be a homeowners insurance discount for subscribing to an alarm monitoring company who will respond or send emergency services in the event of a burglary or fire! It is presumed that the system may lessen the risk of the calamity.

- Geographic Location – Areas where there is less geographic risk would definitely produce a lower premium than areas close to Brush Risk, High Crime Areas, or Areas of High Wind Advisories.

- Prior Claims History – Homes and homeowners without any claim history in the prior 5 years most likely will receive a Claims Free Discount generate a much lower rate than those who hve had claims. In many cases, ‘Preferred’ insurance carriers may only underwrite homes without prior losses therefore not accepting homes with losses, these same carriers would be those who would generate the lowest premium for homeowners insurance.

There are many other rating factors which come into play when calculating your home insurance price; in most States, credit scoring is also used which could substantially change the rate from one identical house to another – statistics show that a homeowner with excellent credit would be less likely to present an exaggerated claim to an insurance carrier. Although this is common knowledge, there are 3 states in the Union who presently disallow credit scoring as they feel it isn’t in the consumers’ interest. The insurance industry and all those with good credit generally disagree!

It only takes a few moments to ‘GET A HOME INSURANCE QUOTE’ – you may get a quote online or you may be able to get a lower rate after talking to a licensed representative who may have some pointers or suggestions in your particular situation in order to generate the lowest premium – either way, you may CALL or CLICK for same day coverage!