Understanding Health Insurance Metal Levels

May 28, 2015

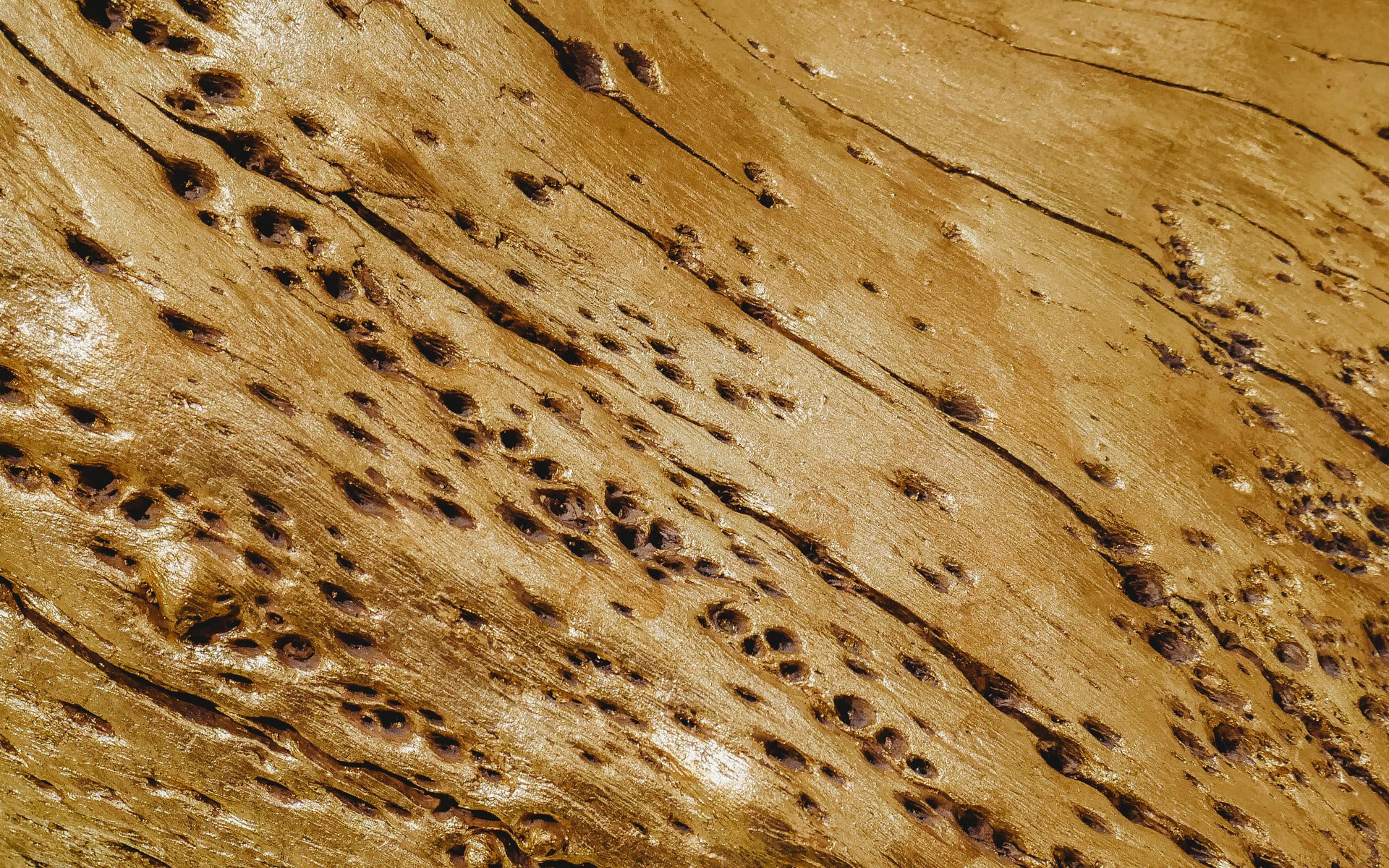

Does Homeowners Insurance Cover Termite Damage?

July 12, 2015Renters Insurance – It has become more commonplace today for Landlords to require Renters Insurance. It has clearly been proven that insured tenants are a better risk for property owners as compared to tenants who don’t choose to insure their belongings. Many tenants are searching for ‘Cheap Renters Insurance Online’ as it is apparent that more and more property owners have become savvy on the topic.

Landlords and Apartment Managers are primarily interested in the Personal Liability coverage included on Renters Insurance; this valuable coverage offers protection on a third party basis to those affected by the negligence of the insured person(s). As an additional note, most Renters Insurance Policies do not have a deductible applicable to the Liability section; thereby offering First Dollar Coverage.

For those seeking only a requirement by the Landlord and wishing to ‘get away’ with the lowest possible premium, purchasing a policy at the minimum Personal Belongings Limit offered, the Highest Deductible option offered and the minimum Liability Limit offered will serve the desire.

Renters Insurance is designed as a Homeowners Insurance Policy for Tenants built as a package policy to include coverage for Personal Contents, Loss of Use, Personal Liability & Guest Medical Payments. These policies are generally very inexpensive and offered by most Preferred Insurance Carriers; the underwriting process is simple; Get a FREE Quote, Select Your Options, Answer a Few Questions, and Print/Save Your Policy.

If the Landlord is requesting to be added to the policy as an ‘Additional Insured’, you should list their Name and Address exactly as required and an Endorsement will be added to the policy listing them as an Additional Insured; the Landlord will automatically be mailed a copy of the policy and any future correspondence.