Why The Recent Spike In Demand For Earthquake Insurance Policies?

July 25, 2015

Homeowners Insurance – What Is Sewer Backup?

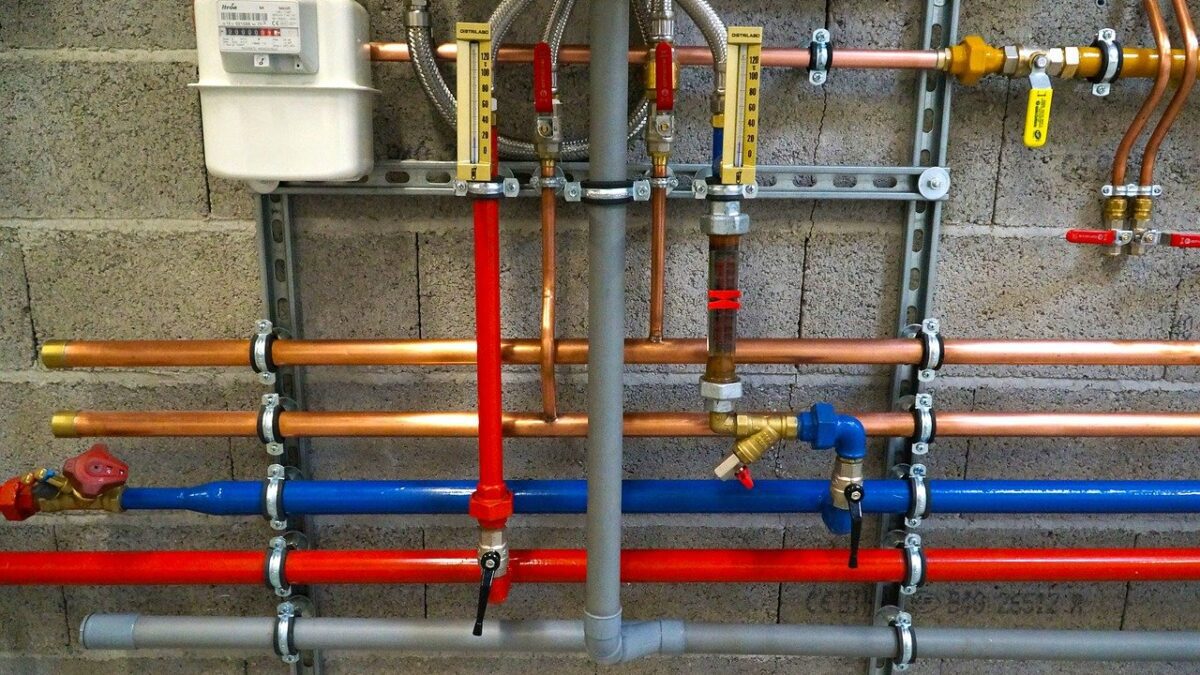

July 26, 2015Home Insurance Plumbing – In most situations, a Homeowners Insurance Policy will cover damage caused by the failure of the home’s plumbing system; however, repairing and maintaining the home’s plumbing is the responsibility of the homeowner. The Insurance Policy is designed to provide coverage for sudden and accidental losses caused by perils listed on the policy; not for maintaining the plumbing or other utility systems in the home.

Insurance carriers expect homeowners to protect their home from unnecessary water damage by taking simple maintenance steps. Simply, for those that are not so mechanically inclined, an inexpensive plumber visit to the home perhaps installing newer style ball angle stops, new steel braided supply lines, new toilet siphon valves and new washing machine supply hoses would avert most water damage issues which insurance companies are faced with on a daily basis.

In colder weather climates, plumbers may recommend leaving a faucet slightly open to drip water in temperatures dropping below 20 degrees Fahrenheit; extended stays away from home may require draining the water from the pipes to avoid frozen pipes.

Maintaining the home’s plumbing system in good order would usually cost less than the policy deductible on a single claim; not to mention the headache involved with dealing with an incident and the associated repairs necessary.

It may be time to review your policy and make sure that your policy does afford coverage for interior water damage and other available options. Since every carrier has different endorsement options available which also vary from state to state, it would be helpful to know what coverage your specific policy includes. It would also be wise to read through the policy exclusions in order to understand any loopholes in your coverage.

If you are in the market for a new Homeowners Insurance Policy, you may start with a FREE Homeowners Insurance Quote today; if you understand the coverage and have no questions, you may purchase your policy online without the assistance of a company representative. If you have any doubts or any questions, it is best to solicit the assistance of a licensed representative so that you can make a better decision about what coverage you elect.