California Earthquake Drought

June 4, 2019

Best Home Insurance Discounts

September 3, 2019You’ve worked so hard to build equity in your home…

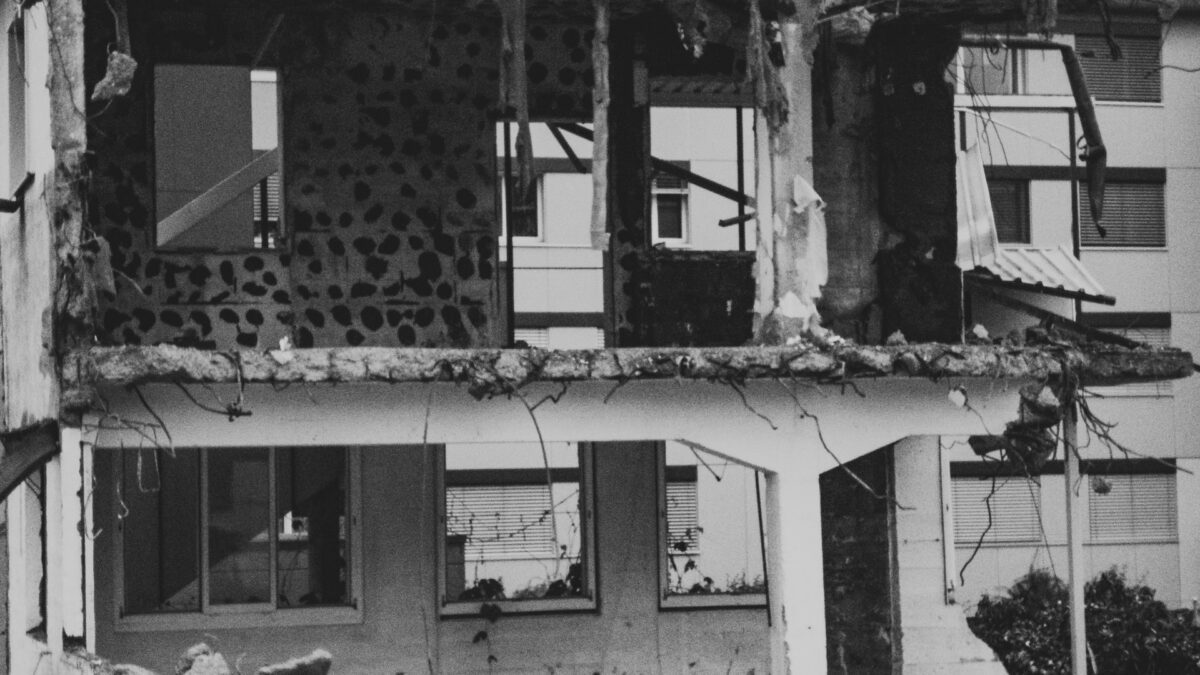

Your home is possibly your most valuable asset, very possibly the asset that your retirement may be relying on; your home is also located in one of the most earthquake prone areas of the country. Mortgage companies require you to insure against Fire, Lightning & Wind; in some areas, they require you to insure against the risk of Flood – but HOW ABOUT THE VERY LIKELY POSSIBILITY OF EARTHQUAKE DAMAGE?

In July of 2019, we experienced an unbelievably huge earthquake which was felt from Fresno, CA in the North to Orange County, CA in the South, to Las Vegas, NV to the East, and Santa Barbara, CA to the West. A series of ‘Ridgecrest Earthquakes’ which occurred over a span of 4 days and included no less than 200 tremors shook nerves as far North as Oregon.

Our company New Business Call Centers were inundated with instant inquiries about earthquake insurance immediately after the shaking stopped! Is this the time to Buy Earthquake Insurance? Insurance is defined as ‘transfer of risk’; from you to the insurance company. Insurance is also referred to as a ‘Risk Pool’ whereby we all place our bets and when the inevitable happens, we have a safety net.

Insurance is NOT a ‘Rich Uncle’ willing to lend a hand and pay bills after a devastating event. Insurance companies must protect the Risk Pool as the money in the bucket is the result of hard working responsible policyholders who have entrusted their money with an insurance company who has promised not to take on adverse risk and therefore minimize risk to protect the integrity of the pool of funds. Insurance is underwritten for the unknown in order to provide security.

Perhaps, the Pacific Coast has had many recent reminders about the fury of our planet; if you feel that this is the time to understand how earthquake insurance may or may not be helpful to your financial security, please do reach out. It is essential to understand the mechanics of the Earthquake Coverage Options, Earthquake Deductible and receiving a quote for Earthquake Insurance to see how little this very valuable financial protection will cost in comparison to a very probable calamity which we simply don’t know when it will occur!

Earthquake Insurance is not for everyone; for example, it is very difficult for anyone to prove that buying Earthquake Coverage will be helpful to a new homeowner who has a 97% mortgage loan to value before the earthquake – certainly this example would leave the homeowner devastated especially in the event of a total loss but arguably with recent seismic events in the past 40 years, real estate values have dipped as much as 50% immediately after such an event and lasted for at least 2 – 3 years.

On the other hand, the best candidates for earthquake insurance and certainly 90% of earthquake insurance consumers seem to be those with a strong equity position in their home and truly don’t want to be left handling the risk alone. For these same consumers, it is common to see the purchase of a higher deductible percentage in order to pay a lower premium and stay insured for the long term.

Although we do have automated links to obtain Earthquake Insurance, most of our earthquake insurance purchases are made following a short personal interview and guidance to a product covering exactly the items of concern to the homeowner. Please do take a few moments to review this very valuable coverage and feel free to do your due diligence.

Get your FREE Earthquake Insurance Quote TODAY!

Your protection is only as strong as its weakest link. There are thousands of earthquakes each year in California, Oregon, and Washington. All it takes is one. Get your earthquake insurance quote today to learn how to strengthen your home’s protection. If you can’t afford to insure 90% of your home, at least insure 75% and safeguard all you have worked for!