Small Business Insurance – Underinsured

January 25, 2024

THE 5 MOST TENANT-FRIENDLY STATES

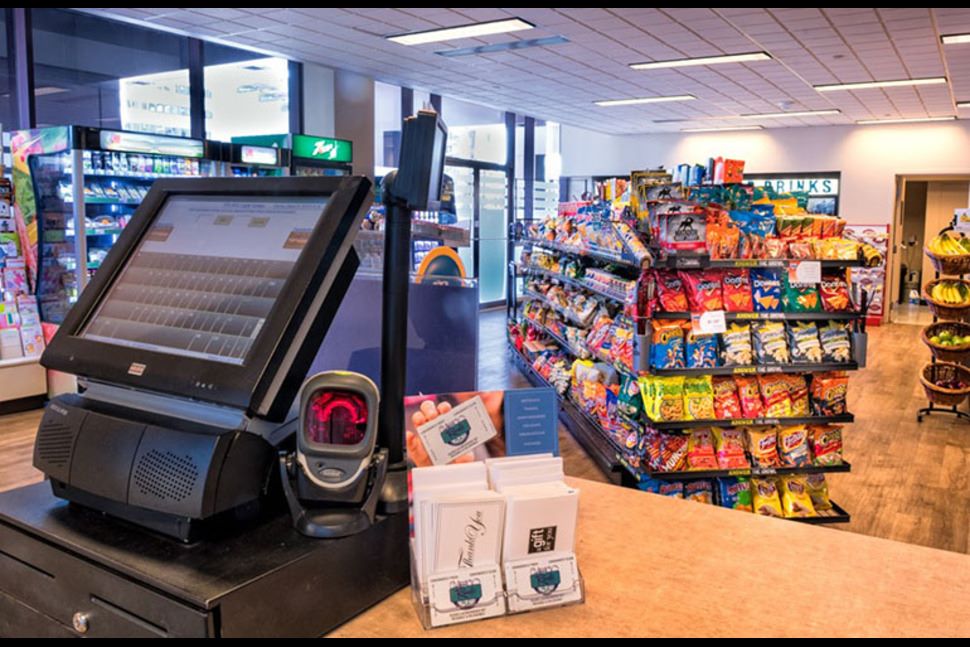

February 12, 2024Convenience stores play a crucial role in meeting the immediate needs of customers on the go. With an average 4.2% growth in the number of convenience stores over the past five years, this industry represents a significant opportunity for continued growth. As with all types of businesses, it’s essential to understand the unique risks associated with this retail sector.

Understanding the Operations

Convenience stores, falling under the category of Retail Food and Beverage, have diverse operations that include selling perishable staples, immediate need products, and even offering services like gasoline, car washes, and lottery tickets. To ensure comprehensive coverage, businessowners should consider the following:

- General Liability Coverage

Given the high foot traffic and varied services, convenience stores face potential risks like slips, trips, and falls. Adequate general liability coverage is crucial to protect against premises liability exposures.

- Workers Compensation

The nature of convenience store operations involves lifting, potential floor hazards, and the risk of employee injury during a holdup. Workers compensation coverage is vital to address these concerns.

- Property and Equipment Breakdown

Property exposures stem from electrical wiring, refrigeration units, and cooking equipment. Equipment breakdown coverage is essential as operations heavily depend on refrigeration equipment, cooking facilities, and fuel pumps (if fuel is sold).

- Crime Exposure

Convenience stores, operating during late hours and handling a significant number of cash transactions, are susceptible to both employee dishonesty and theft. Adequate crime coverage, including employee background screening and inventory monitoring, is crucial.

- Inland Marine Exposures

Consider coverage for accounts receivable, computers, signs, and valuable papers. These items are integral to the convenience store’s day-to-day operations and need protection.

- Liquor Liability

If the store sells alcohol, liquor liability coverage is essential. Business owners should ensure compliance with state and federal regulations, including age verification procedures. Most carriers write liquor liability coverage on convenience stores that have less than 50% of their sales from alcohol or tobacco.

- Auto Exposure

While automobile exposure is generally limited, businessowners should consider hired or non-owned auto liability coverage for employees running errands.

- Products Liability

Given the potential for food poisoning, contamination, and allergic reactions, products liability coverage is crucial. Monitoring food quality, maintaining proper storage, and accurate record-keeping can help mitigate this exposure.

Recommended Coverage Checklist

Businessowners should consider the following coverage options based on the specific needs of the convenience store:

- Business Personal Property

- Spoilage

- Business Income and Extra Expense

- Equipment Breakdown

- Employee Dishonesty

- Money and Securities

- Computers

- Signs

- Valuable Papers and Records

- Employee Benefits

- Umbrella

- Hired and Non-owned Auto

- Workers Compensation

Additional Coverages to Consider

- Building

- Leasehold Interest

- Real Property Legal Liability

- Computer Fraud

- Forgery

- Accounts Receivable

- Cyber Liability

- Employment-related Practices

- Environmental Impairment

- Liquor Liability

- Business Auto Liability and Physical Damage

- Stop Gap Liability

By understanding the intricacies of convenience store operations and the associated risks, business owners can choose tailored coverage solutions for their business. This comprehensive approach ensures that convenience store owners are protected against a wide range of potential challenges, allowing them to focus on their core business operations without undue financial strain.

Whether you’re looking to buy a new business or insure your current business, HDA Insurance Brokerage is available to answer questions and assist you in the process. In the case of a simple business enterprise, you may obtain a DIY FREE Small Business Insurance Quote Online when you’re ready.