When Is Best Time To Sell A House?

September 22, 2023

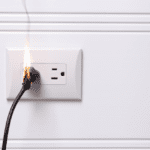

Electrical Safety in the Home

October 6, 2023While a manufactured home is more affordable than a traditional site-built home, it’s an excellent option for a homebuyer on any budget. The benefits of financing a manufactured home go well beyond affordability. Manufactured homes today are built to higher construction standards than in the past, resulting in stronger and safer homes. You can also customize them to fit your preferences, with more choices for floor plans, interior finishes and exterior styles than ever before. In addition, if you’re looking for a more sustainable homeownership option, many modern manufactured homes are designed to be energy efficient, which can reduce your energy use so you can save on utility bills.

For buyers building their credit and looking for low or zero-down payment options, learn how owning a new home is possible with manufactured home financing options.

What is a Manufactured Home?

A manufactured home is a type of housing built in a factory and transported to a site where it’s assembled and installed. They’re constructed under federal building codes established by the U.S. Department of Housing and Urban Development (HUD). These codes set standards for designing, constructing and installing manufactured homes, ensuring they’re safe and durable. Modern manufactured home trends are much different from those of the past, with many customizable options and add-ons available.

CrossMod™

A CrossMod™ is a newer type of HUD-code manufactured home built to higher standards to resemble traditional site-built homes with curb appeal to fit in any neighborhood. CrossMod™ represents the blending of features built on-site to create a new class of homes (cross or crossover) and the innovative, efficient methods used in off-site home construction (mod or modern).

Because they’re constructed in a controlled environment, these homes can be made much more efficiently, which lowers the cost of construction and helps improve affordability for new homebuyers. They can be built in various floor plans, including open concepts, with the same square footage as traditional homes. You can also customize them with a wide range of features like front porches, decks, pitched roofs, garages and carports. And they offer options for increased energy efficiency.

Manufactured home financing requirements

- Pick the right size—single, double or triple-wide

Three sizes of manufactured homes can be financed—from single-wide homes that are narrower and shorter to double-wide or triple-wide homes that are larger and more spacious.

| Living space | Bedrooms | Bathrooms | |

| Single-wide | 500 to 1,200 square feet | 1 – 2 | 1 – 2 |

| Double-wide | 1,000 to 2,200 square feet | 2 – 3 | 2 |

| Triple-wide | Over 2,000 square feet | 3+ | 2+ |

Source: The Homes Direct

- Home must be manufactured after June 15, 1976

In 1976, HUD established new construction and safety standards for this type of housing, formerly known as mobile homes, which resulted in a new classification of homes called “manufactured homes.” Today, manufactured homes are the standard type of prefabricated home and are built to the HUD standards.

- Property must be fee simple

Unlike leasehold ownership, which only grants you the right to use a property for a limited period, fee-simple ownership gives you full and absolute ownership of your property and the right to use, sell, mortgage, lease or otherwise dispose of the property as you wish, subject only to applicable laws and government regulations.

- Affidavit of Affixture (433A or state equivalent)

When a manufactured home is initially placed on a site, it’s considered personal property and is subject to the same legal treatment as a car or other movable property. However, if the home is permanently affixed to a foundation and you own the land, your home can be converted to real property by filing an Affidavit of Affixture.

This document certifies that your home has been permanently affixed to a foundation and that you intend for it to be considered real property. The Mortgage Reports recommends contacting a settlement or title company to guide you through this process.

- Home must be transported directly from the manufacturer to the site

A traditional home is built ground up on your property. A manufactured home is constructed and assembled in a factory, then transported and placed on a foundation on your land.

How much does a manufactured home cost?

According to the Manufactured Housing Institute (MHI), a significant advantage of a manufactured home is that the average price per square foot without land is nearly half of the cost of a conventional site-built home.

Steps to finance your Manufactured Home

If you’re looking to buy a manufactured home, follow these important steps:

Step 1: Connect with a Mortgage Company

Whether you’re a first-time homebuyer or an existing homeowner upsizing or downsizing your living situation, there are many different types of manufactured home loans for a wide array of borrower situations. Licensed loan officers have an in-depth knowledge of manufactured home loan programs and their requirements and can pair you with the one that best fits your life. It’s never too early to reach out to discuss your homeownership goals.

Step 2: Determine your Budget

Affordability isn’t only measured by your monthly mortgage payments. Before starting your search, set up a budget to track all potential homeownership costs. Other factors affecting your ability to finance your manufactured home include your down payment amount, total monthly debt and common homebuying expenses. A loan officer will be able to help by giving you an estimate of your manufactured home purchase price and the loan amount you can afford.

Step 3: Check your Credit Report

When applying for manufactured home financing, your credit score and the financial information on your credit report can determine the terms of your loan and, ultimately, whether you’re approved. So check your credit report before you start the mortgage application process; you may initially check with your credit card company since many of them have free credit report review tools to make a quick cursory check to see if you have any areas of concern. Then, report any errors or incorrect information to the credit reporting agencies.

Step 4: Determine your available Down Payment

The amount of your down payment will vary depending on your manufactured home price, the type of loan and your credit history. You may even qualify for a loan with little or no money down. In addition, first-time homebuyers and individuals with incomes below area median levels may be able to increase their buying power with a down payment assistance program.

Step 5: Research Manufacturers

Manufactured homes are usually purchased through dealers or retailers that sell the homes. Look up manufacturers and dealers of homes in your area online or ask for recommendations from friends or family who have purchased these types of homes. Then, visit showrooms to see display homes and customization options.

Step 6: Find a Real Estate Agent

When purchasing land and a manufactured home, consider finding a real estate professional familiar with the market. They can help you find suitable properties and can also assist with the homebuying process.

Step 7: Complete a Loan Application

Pre-approval helps you narrow the price range for your manufactured home and directs how much you should save for a down payment.

Whether you’re looking to buy, sell or refinance your home, HDA Insurance Brokerage is available to insure your new property; whether an owner-occupied home or a tenant-occupied rental unit. You may obtain a FREE Home Insurance Quote Online when you’re ready.